Impact Investing: Overcoming Resistance from Family and Board Members

Editor’s Note: Impact investing is of growing interest to the many thousands of philanthropic families around the world who manage their philanthropy through family foundations and family offices. In this month’s edition of Family Giving News, we present practical solutions and advice regarding one of the most commonly cited challenges for getting started in impact/mission investing: getting internal buy-in. The text below includes excerpts from The Guide to Impact Investing For Family Offices and High Net Worth Individuals, a comprehensive new resource for families, individuals, family offices, and family foundations, authored by Julia Balandina Jaquier.

Part I: Impact Investing and Family Foundations

Traditionally, investing and philanthropy have been two distinct activities that never overlapped. Over the past few decades, the landscape of available instruments for achieving financial and social returns has evolved. Foundations now have at their disposal an expanded set of tools to attain their missions, with impact investing being one of the key ones.

The growing interest on the part of private foundations to the field of impact investing is hard to miss. Commonly referred to as investments intended to create a measurable positive impact as well as financial return, impact investments fund ventures that have both a social mission and that address current global challenges through market-driven mechanisms. These ventures operate in different parts of the world and in a variety of sectors – see examples below.

Fig. 1: Examples of Impact Investment Opportunities

Impact investments can be broadly segmented into two main groups – Impact First investments and Financial First investments. The primary aim of Impact First investments is to generate social or environmental good. These investments often, but not always, yield sub-market returns. Financial First impact investments seek to achieve market-rate returns while making tangible positive impact.

Impact investing differs from socially responsible investing in that it actively pursues positive impact; it differs from grants and venture philanthropy by requiring a certain level of financial return. Impact investing can be practiced across numerous asset classes, with the majority currently representing private equity and debt.

Impact investing is a fast growing, but still nascent market. The GIIN (Global Impact Investment Network) projects 10-fold growth over 5 years from $50 billion at the end of 2009 to $500 billion by the end of 2014, placing impact investing at roughly 1% of all globally managed assets.

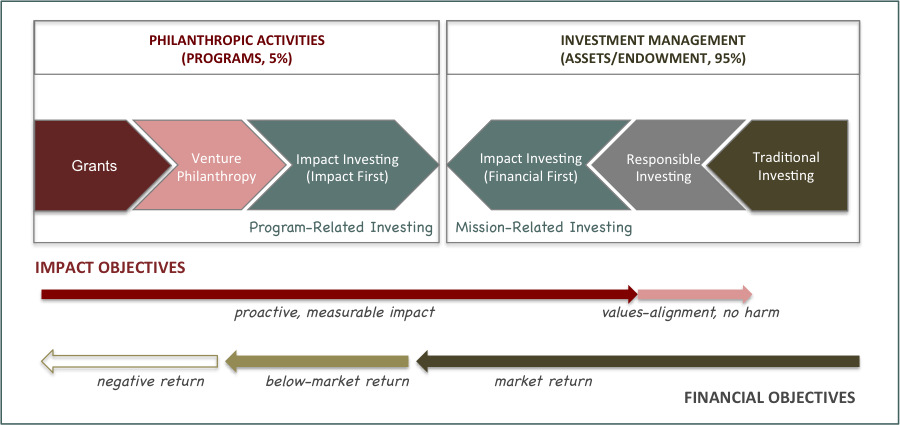

Foundations typically use Impact First investments on their programmatic/philanthropic side to complement their grants and venture philanthropy. Such investments, called program-related investments or PRIs, enable foundations to leverage their grant dollars, as PRIs in the USA and some other countries are considered charitable expenditures and are included within a foundation’s typical 5% annual payout requirement.

On the endowment side, foundations allocate a portion of their assets towards Financial First impact investments, alongside their traditional and responsible investments. Such impact investments are called mission-related investments or MRIs and they allow foundations to deploy a larger portion of their resources to advance their mission, while yielding them market-rate returns.

All of these financing and investment approaches can be seen as a new continuum that allows a foundation to incorporate both impact and financial objectives in its investment management.

Fig. 2: Use of Impact Investments by Foundations – a New Continuum

Source: JBJ Consult

Family foundations around the world have been in the vanguard of the impact investing movement and a growing number of wealthy families and their foundations have successfully adopted impact investing. Examples of just a few of these institutions are provided in Figure 3; a more complete list of family foundations involved in impact investing is available from the Mission Investors Exchange site.

Fig. 3: Examples of Family Foundations & Family Offices Involved in Impact Investing

Many more wealth holders and private foundations have been interested in impact investing for years, but have not started “doing it.” What is the reason? One of the most common challenges to getting involved in impact investing is the ongoing resistance of families and trustees due to unfamiliarity with this investment approach. Part II of this article looks at potential solutions and tips for overcoming this resistance.

Part II: The Challenge of Getting Internal Buy-in

Families practice impact investing both through their private foundations as well as through their family offices. In both cases, an impact investing strategy is typically adopted after a ‘champion’ emerges to engage the board and/or other family members in thinking about the potential of this approach. A family is a complex organization and getting everybody on board can be especially challenging, particularly as implementing an impact investment program may require changes in how foundations and wealth management activities are managed. It’s often the case that the family members pushing for this change are young and have not yet ‘proven themselves’ to their families. Surprisingly, even family patriarchs may have to deal with resistance from their families. It also does not help that traditional advisers, trusted by the older generations, are often not knowledgeable and supportive of impact investing.

SOLUTIONS AND TIPS TO OVERCOME RESISTANCE FROM FAMILY AND TRUSTEES

Listed below are several possible solutions to the ‘buy-in’ challenge, along with actual quotes from family members who have been through this process. These solutions are based on feedback from over 40 private impact investors who have shared their experiences and tips in The Guide to Impact Investing, a well as on the author’s experiences advising family foundations and wealth holders. Keep in mind that it may require a combination of two or more of these strategies over a period of several years for success to be achieved.

A. Use External Experts and Other Families: Younger family members who struggled to ‘be heard’ by older generations often found it helpful to use a third party – an advisor, outside family foundation representative, or investment expert – to explain the merits of impact investing. Tailor-made training on impact investing for the foundation board/senior family members can be very effective, by properly addressing such issues as reputational risks, evidence of performance, and fiduciary duty – each of which tend to be major reasons for initial internal resistance.

“As a family member, given your dynamics and history, they’re not going to listen to you. You just have to accept that. So I brought in another family that was involved in impact investing.”

“It took an advisor, somebody with a clear track record of financial expertise, to really start changing things.”

B. Use Case Studies and Success Stories: Typically, skeptical board and family members need to be convinced of two things: 1) on the programmatic side, that an impact investment can be more impactful than a grant; and 2) on the endowment side, that an impact investment can generate market-rate returns while supporting the mission of the foundation. While impact investing does not yet have a track record on an industry level, there are a number of powerful success stories that can be used to prove your points (Part V of The Guide to Impact Investing includes 14 investment examples across asset classes, some of which are available for download). Sharing case studies and performance data from pioneering private foundations (notable examples include the F.B. Heron Foundation or KL Felicitas Foundation) can also be very useful.

“With our family the struggle has been the lingering distrust of impact investment, the fear that it will be either a lousy grant or a lousy investment dressed up as something else. They haven’t come across enough success stories, tangible, hands-on experience in this space to not feel that it’s impossible to combine financial and philanthropic goals, to ‘eat your cake and have it.’ ”

C. Find Real-Life Investment Opportunities and Speak the Financial Language: Many family members pushing for impact investing are not considered by their families to be “investment savvy.” Bringing real-life impact investment opportunities and carefully arguing their merits on the financial side will increase credibility and create support from the more financially driven and analytical side of the family and trustees. For example, an investment in real assets, such as land conservation, organic farming, or sustainable forestry, or a fixed income investment in a microfinance debt fund or community development bond is likely to catch the attention of your family as it can deliver a mix of financial returns and diversification benefits, inflation protection, or low volatility.

“I could get my brothers excited about really cool investments that were totally financially viable and created a model for sustainability. They appreciated the value of that from their sort of investor minds and got enthusiastic about the fact that a tool like this exists.”

D. Be Persistent. Do Not Give Up: Those who succeeded in changing the perception of their family members or foundations boards recall that it was a lengthy and tedious process with many iterations, new strategies, and outside expert engagement. In some cases, it took many years to gradually win over the more skeptical board and family members. Do not give up too soon, thinking all is hopeless – it may just take one last effort to create the tipping point.

“It’s taken ten years, and it’s taken me working with every board member, sending them content, inviting them to conferences, introducing them to people that I thought were going to give them good advice.”

E. Secure the Support of an Older, More Senior Family Member: If you are trying to convince the older generations, enroll the support of family members who ‘carry more weight’ within the family structure – often from the generation of the family patriarch.

“There were two uncles who were of my father’s generation. They had invested in microfinance in the 1980s… They saw me coming up with this impact stuff, and they said, ‘Wow, this is cool.’ So I got a lot of support from them and their colleagues, which really helped.”

F. Join a Group of Peers/Form a Support Group: It may be difficult to convince your own family, particularly if the situation is influenced by family dynamics, or if egos play a significant role in board and family wealth decisions. Being part of a group of peers who are struggling with the same issues or have gone through similar situations has helped a number of wealth holders, if not to win the fight, then to at least not give up (see Figure 4 for examples of these networks).

“It helps to have support. You need emotional support; you need to be a part of a group of like-minded people. You need to know that the fight you’re fighting with your financial advisor and your family is a fight that you can win.”

Fig. 4: Examples of Impact Investment Groups and Networks

G. USE MEDIATION: When the decision to move into impact investing depends on an agreement from a number of family members, the buy-in process can easily become emotionally charged, especially if inter-generational issues are at play. A number of families have engaged an external mediator to understand positions of various members and help craft a solution that addresses the concerns and aspirations of the family in a neutral and constructive manner.

“We have contracted with a consulting company to do a facilitation exercise with the family to really come to some consensus about what the values and guidelines are that we should create for our sustainable investments.”

H. DEVELOP THE ‘PILOT PORTFOLIO’ TO PROVE YOUR CASE: Some wealth holders, while or before trying to convince their families, started to invest using their own capital, effectively creating a “pilot” portfolio. This allowed them to prove their case to the family and to learn the ropes of impact investing. Such a pilot can mirror the core programmatic areas of the family foundation, if the objective is to prove that an impact investment can be as impactful as grants. Alternatively, one should focus on Financial First investments, if you want to prove the ability to protect and grow the endowment, while aligning it with the mission of the foundation. Do not underestimate the effort of this exercise, as you will need time and skills to build a successful pilot.

“I’ve done a number of investments on my own that are completely outside of what the family does… My strategy was to try it out with my own money, and then if it’s mature enough or it’s proven … I will offer it to the Family Office.“

Part III: Tips for Getting Started with Impact Investing

Ready to get started? Below are some peer recommendations to make your impact investment journey both easier and more fun:

1) START WITH YOUR VALUES: Think of what the family values are and where you would like to make an impact – is it saving the Amazonian rainforest or educating kids in Nepal? Examine whether the mission of your foundation could be achieved through impact investing. A strong link to your values and foundation mission will make impact investing more meaningful and fun.

2) LEARN ABOUT THE SPACE: Many resources are currently available including written reports, conferences, and private gatherings – use them. Meet other foundations and consider a tailor-made training on impact investing for your family, trustees and foundation staff. Mandate your current investment advisor and staff to research the impact area(s) and report with investment proposals that could advance the mission of your foundation while yielding a financial return.

3) TAKE A STEP-BY-STEP APPROACH: You may have ambitious plans, but allow time to develop and implement an effective impact investment strategy. You can start small and/or safe. On the programmatic side, provide a loan in place of a grant. On the endowment side, invest in a fully guaranteed certificate of deposit, pledge liquid portfolio as a loan guarantee or invest through financial intermediaries. Become bolder as you learn, develop internal capabilities and find experienced partners.

4) BE RIGOROUS: Treating impact investing as a “hobby” is a sure path to failure. Impact investing requires a mix of programmatic and investment skills and should be executed professionally. Some foundations started by outsourcing the financial due diligence to experienced investment professionals, while others have built internal investment capabilities from the onset.

5) ALLOW YOURSELF TO MAKE MISTAKES: Do not underestimate the challenges of impact investing. Be prepared to experiment and do not give up when mistakes occur (they are unavoidable) – learn lessons and adjust your strategy accordingly.

6) COLLABORATE: Join an investment club or a network in your region and start interacting with peers who are further down the road of impact investing (see Figure 4 for suggestions). This way you can leverage their experience, skills, and resources, reducing the risks and due diligence cost.

7) ANALYZE AND MEASURE YOUR IMPACT: Do not settle on intentions and promises of impact – understand, measure, and drive the impact of your investments, as well as their financial performance. A number of methodologies exist to facilitate this task and can be tailor-made for your needs.

Conclusion: Learning to Swim

When executed with rigor and skill, impact investing enables philanthropic families and foundations to make a real difference in the world while still maintaining and growing their philanthropic assets, having fun, and feeling connected and fulfilled. Test it yourself, allocate a small portion of your assets, and make a few investments you can really connect with and learn by doing. As Sir Ronald Cohen said, “You can’t learn to swim by exercising on the beach.”

About the Guide:

The Guide to Impact Investing provides a practical and comprehensive blueprint for starting investing for impact, including a set of guidelines, concrete tools, per recommendations and key insights from many of the most active private impact investors in the world. National Center Friends of the Family benefit from 20% discount (discount code: NCFP).