Background on Business Modeling for Community Foundation Services

Community foundations face tough choices about their overall business models and

the business models and financial models for specific products and services. This

white paper summarizes insights on those choices from inside and outside the

community foundation field. It may be particularly helpful to staff and volunteers

newer to the field of community foundations.

Terminology

What are the differences between a business plan, business model, and financial

model?

In their book The Nonprofit Business Plan, consultants from La Piana Consulting write

that a nonprofit business plan “tests the proposition that a particular undertaking—

program, partnership, new venture, growth strategy, or the entity as a whole—is

economically and operationally viable.”

NCFP’s Family Philanthropy Playbook and its Philanthropic Services Business Model

Canvas for community foundations are tools for business modeling. The La Piana

Consulting team wrote that “The nonprofit business model is the interplay of an

organization’s scope (geographic, programmatic, and customer) with its economic

logic (how it structures and pays for itself)” They note that a good business plan

reassures its readers that the business model “really does makes sense and has a

high likelihood of success.” What is a Business Model? by Harvard Business Review’s

Andrea Ovans adeptly summarizes 10 years of evolving thinking on the definition and

structure of a business model.

The financial model is the underlying economic logic of a business model. It forecasts

revenue streams and cost structures over time and articulates the assumptions made

about both.

Strategic Questions

From 2003-2013, the consulting firm FSG developed reports and tools to help

community foundations better understand their business models. The firm donated

the resources to CF Insights at the Foundation Center.

FSG wrote in its 2013 report, Align, Adapt Aspire, that four questions are

fundamental to making decisions on the economics of any product or service:

1. What are our strategic priorities?

2. What mix of products and services aligns with our strategic priorities?

3. How do we position priority products for growth?

4. What operational changes do we make by product – including pricing,

processes, development focus, and revenue diversification – to achieve the

economic outcomes we desire?

Four Competing Business Models

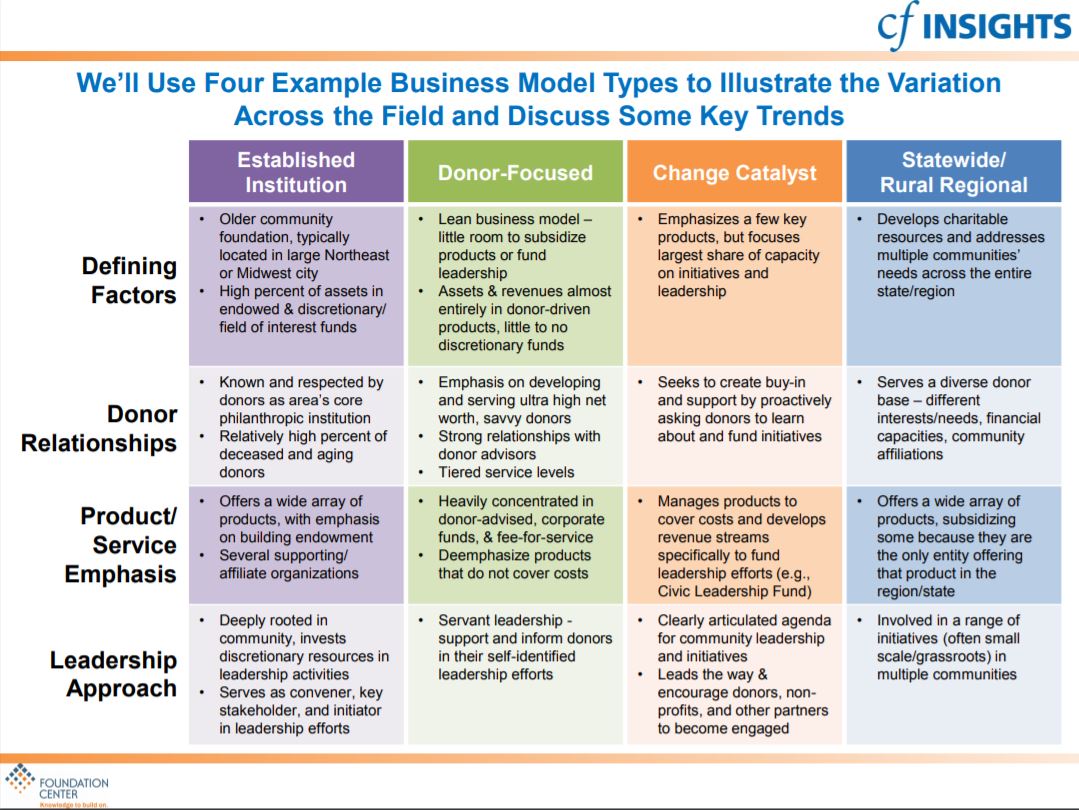

Two consulting firms – Ekstrom Alley Clontz and FSG – developed similar ideas

around four competing choices for a community foundation’s business model. Each

choice creates different and often conflicting demands for staffing, operational

capacities, marketing, donor engagement, and more. Each community foundation is a

mix of the four models, but no foundation can grow effectively trying to do all of

them well. Both firms encourage a community foundation to pick one model as its

key differentiator – its primary means of growing in its market.

Choosing to offer deeper philanthropic services or family philanthropy services falls

in the “Fuel for Change” category in FSG’s 2012 Do More Than Grow report. It falls in

the “Donor Focused” category for Ekstrom Alley Clontz and for CF Insights in its

following graphic and in its presentations.

Trusted Advisor Model

Deloitte’s Center for the Edge studies trends that are disrupting business models.

The trends range from public policies to online flows of information, and from

migration of talent to consumer loyalty and power.

In the 2016 report Approaching Disruption and other articles, the Center describes

three types of businesses that will thrive in the future: “infrastructure providers will

manage routine, high-volume operational tasks; platforms will connect businesses

with a growing range of third parties; and trusted advisers will build deep, trust-based relationships with customers.”

Each type of business requires differing capabilities and culture to deliver value to

the marketplace. The Center for the Edge advises a business to focus on only one of

those three types, and the trusted advisor concept fits a community foundation’s

family philanthropy services well. The Center’s team wrote:

“The trusted advisor seeks to increase a customer’s return on

attention…by proactively and objectively recommending products,

services, and opportunities that help the customer meet her goals.” –

Deloitte, Approaching Disruption, 2016

Center co-founder John Hagel later wrote that the key success factor for the trusted

advisor model is the:

“capability to build and sustain deep trust so that the customer is

comfortable in sharing more and more information about themselves. The

advisors in this business type must have a deep sense of emotional

intelligence so that they can constructively challenge customers and help

them to accomplish even more.”

Cost Structures

NCFP’s Community Foundation Family Philanthropy Playbook is based on the

Business Model Canvas. Experts in this tool write about two opposing choices for the

cost structure of a service or product:

- Cost-driven – your customers value very low costs, so you will dedicate little

staff time to your philanthropic services and focus on mass-market events and

off-the-shelf tools. In this choice, NCFP’s Knowledge Center resources and

webinars can play a key role in augmenting support for giving families. - Value-driven – your customers value premium services such as those received

at a high-end wealth advisory firm or vacation destination, so your

philanthropic services offer more of a concierge and customized experience.

NCFP’s resources tend to play more of a background role in those services.

Most products and services fall somewhere in between those opposite choices, and your mix of philanthropic services will likely a mix of those cost structures. The Seattle Foundation offers both choices in its Donor-Advised Funds, charging 1.25% for value-driven services and 1.00% for cost-driven services.

Business Model Canvas experts also look at these characteristics of a cost structure:\

- Fixed costs – expenses that are not dependent on the amount of goods or

services being delivered. These include overhead costs and salaried staff. - Variable costs – expenses that change in proportion to the amount of goods

or services being delivered. These include materials, meeting costs, processing

costs per gift and grant, and more. - Economies of scale – as volume rises, so does the overall cost per product or

service. Common examples are bulk purchasing and reduced fees for larger

loans or deposits. - Economies of scope – cost advantages available due to a larger scope of

operations. For example, a highly-skilled marketing office can effectively serve

multiple lines of business, or existing distribution channels can be used for

multiple products.

Revenue Sources

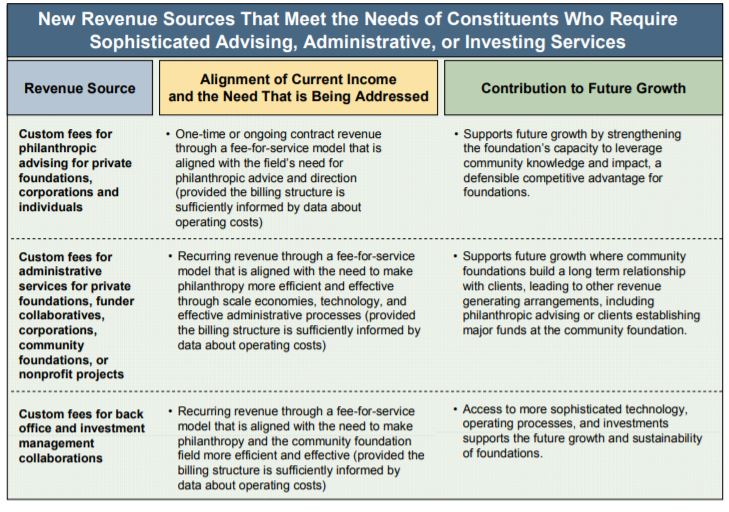

FSG’s 2010 report, Fueling Impact: A Fresh Look at Business Model Innovation and

New Revenue Sources, documented how community foundations were diversifying

their revenue sources beyond standard fees on fund assets. This chart described fees

for advanced philanthropic services and family philanthropy services:

Many community foundations are now offering fee-based services and products to

their donors and fund advisors and to private foundations. Subscribers to NCFP’s

Community Foundation Network can access a folder full of sample fee structures,

project scoping templates, and agreements.

Three Case Studies

In this excerpt from NCFP’ 2005 issue brief, Making the Commitment to Family

Philanthropy, author Bryan Clontz offered three examples of how community

foundations navigated business model choices for family philanthropy services. He

based the examples on three factors:

- How closely family philanthropy services fit the foundation’s overall mission

- The staff and budget capacity of the foundation

- The decision to offer “standard services” to a wider customer base and “addons” and “enhanced services” for families and other high-priority customers.

Tier 1 – Partial Mission Fit with Limited Resources and Capacity

Rationale and strategy: Be a solid, high-quality core resource for families who practice philanthropy. Minimize overall cost, invest in fixed- cost resources, avoid hard-to-control variable costs, especially staffing. Primary service delivery is on a doit-yourself basis. Begin to segment high-end funds for potential users of add-on services, outside resources, and prospects for future specialized fee services.

Standard Level:

- Lending library resource materials

- Reposition current services to adapt to families

- Off-the-shelf “How To” tool kits:

o Develop a grantmaking strategy

o Organize your family philanthropy process

o Engage your children

o Help your children develop good practices, etc. - Stable of outside resources for referrals

- Add-ons:

o NCFP’s Knowledge Center

o NCFP’s monthly family philanthropy webinars

Tier 2 – Minimal Mission Fit with Ample Resources and Capacity

Rationale and strategy: Be a solid, high-quality complete resource for families who

practice philanthropy. Segment high-end funds for enhanced level services. Invest in

fixed cost resources, minimize hard-to-control variable costs, especially staffing,

reserving them for enhanced level personalized and customized services. Deliver as

much as possible on a do-it-yourself basis.

Standard Level:

- Lending library resource materials

- Reposition current services to adapt to families

- Off-the-shelf “How To” tool kits:

o Develop a grantmaking strategy

o Organize your family philanthropy process

o Engage your children

o Help your children develop good practices, etc. - NCFP’s Knowledge Center

- NCFP’s monthly family philanthropy webinars

Enhanced Level:

- Family philanthropy events

- Alliances with outside resources to provide needed special services to donor families (and train staff)

- Selected personalized and customized services for a fee

Add-ons:

- Offer contracted grantmaking, administrative, and other services to private/family foundations

Tier 3—Optimal Mission Fit with Abundant Resources and Capacity

Rationale and strategy: Be a solid, high quality full range/full service resource for

families who practice philanthropy, including family foundations. Segment high-end

funds/foundations for enhanced level services. Invest in fixed cost resources,

minimize hard to control variable costs, especially staffing, reserving them for

enhanced level personalized and customized services. Deliver as much as possible on

a do-it-yourself basis.

Standard Level:

- Lending library resource materials

- Reposition current services to adapt to families

- Off-the-shelf “How To” tool kits:

o Develop a grantmaking strategy

o Organize your family philanthropy process

o Engage your children

o Help your children develop good practices, etc. - NCFP’s Knowledge Center

- NCFP’s monthly family philanthropy webinars

Enhanced Level:

- Family philanthropy events

- Alliances with outside resources to provide needed special services to donor families (and train staff)

- Selected personalized and customized services for a fee

- Custom grantmaking services to private/family foundations

Add-ons:

- Administrative services for private/family foundations

Note: These models are also readily adaptable for donor family segments with a community foundation based upon the fee income levels.