Family Offices and Family Philanthropy

Posted on November 8, 2012 by Anne Etheridge, Craig Muska, Elizabeth “Buffy” Minkin, Jim Frey, Sara Hamilton

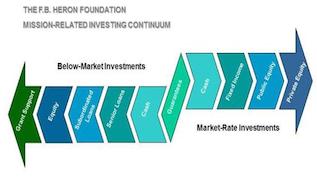

As the field of family philanthropy continues to evolve, the options available to families for managing and making the most of their giving are expanding at a rapid pace. One option that a growing number of philanthropic families are considering is the creation of a family office - a private entity that manages the investments and trusts for a single family, while also providing a variety of other personal services, among them philanthropic advising or the housing of a family foundation… Read More