Finding the Right Advisor to Help Align Your Investments With Your Values

Addressing the world’s most pressing issues will require harnessing the power of all investment capital—including the corpus of foundations. While allocating 5% (the minimum required by law) of your foundation’s resources to support its mission can result in powerful solutions and social change, imagine if the remaining 95% were invested to further your goals and objectives?

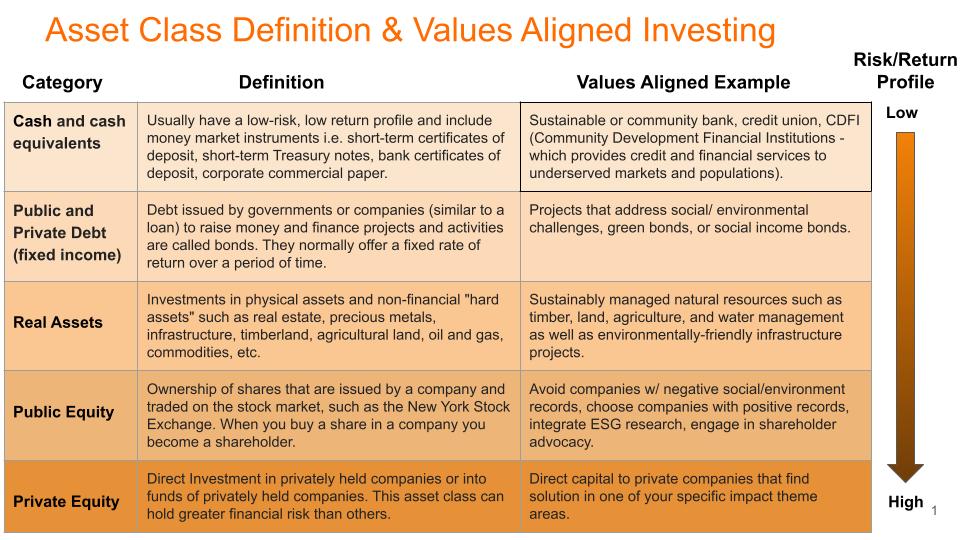

Values-aligned investing, an umbrella term that includes mission-aligned, impact, and sustainable investing, refers to investing in a way that furthers an asset owner’s environmental and/or social goals at market or concessionary rates of return. When a foundation moves its investment capital into mission alignment, it has the opportunity to “walk its talk” and leverage 100% of its available capital to solve important social issues. Adopting a values-aligned investment strategy can be a powerful force for change and removes the risk that a foundation’s investments may work against its mission (i.e. investing in fossil fuel companies while granting to organizations that work on climate change).

Values-aligned investing examples in various asset classes. Courtesy of The Take Two Money Course (https://courses.www.taketwojournal.com/)

How to get started?

It can be difficult to know where to begin and talking to your existing financial advisor is a great place to start. The first step is to determine your intended impact. If you’re trying to determine whether your investment advisor has the expertise to implement your mission-aligned investing strategy, below are some questions that may help:

- What percentage of the advisor’s assets under management (AUM) are values-aligned (i.e. how many clients and how much capital are they managing in this way)?

- For how many years has the advisor offered services in values-aligned investing?

- What are the impact areas that they offer values-aligned investment opportunities in?

- In which asset classes will the advisor invest to meet both your impact and financial goals?

- Can the advisor share specific examples of impact investment options in each asset class? For example, if you’re seeking investment in private equity, the advisor might offer investments in companies that work in cleantech and renewable energy, education, healthcare, access to fair financial services, and those that promote diversity and gender equality. If you’re investing in public equities, the advisor might apply positive/negative screens, integrate ESG (environmental, social, and governance) criteria, and/or engage in shareholder advocacy.

- How will the advisor enable you to engage in shareholder advocacy (i.e. vote proxy statements) for the public equities portion of your portfolio?

Additional questions can be found here.

If you’ve determined that your advisor doesn’t have the expertise you need, you need not be concerned: there are many advisors who do. ValuesAdvisor, a nonprofit resource developed to help move money into alignment with values, offers a database of financial advisors specifically chosen for their expertise in values-aligned investing services. The platform provides relevant information about an advisor’s experience and enables investors to filter the universe of advisors based on their specific needs.

NCFP members receive free access to ValuesAdvisor. Login and click here to learn more about how to access the database.

More resources on values-aligned investing

- Impact Investing (NCFP content collection)

- Impact Strategies and Tools (NCFP primer)

- Impact Investing, and What I Wish I Knew When I Started (NCFP blog)

- Impact Investing: Aligning All Capital for Good (NCFP webinar)